The amount of the property tax bill did not depend on the number of units produced or the number of machine hours that the plant operated. Although the fixed manufacturing overhead costs present themselves as large monthly or annual expenses, they are part of each product’s cost. Because fixed overhead costs are not typically driven byactivity, Jerry’s cannot attribute any part of this variance to theefficient (or inefficient) use of labor.

Get in Touch With a Financial Advisor

In this example, the fixed overhead budget variance is positive (2,000 favorable), and the fixed overhead volume variance is negative (-1,040 unfavorable), resulting in an overall positive overhead variance (960 favorable). Fixed overhead budget variance is favorable when actual fixed overhead incurred are less than the budgeted amount and it is unfavorable when the actual fixed overheads exceed the budgeted amount. Variable overhead spending variance is favorable if the actual costs of indirect materials — for example, paint and consumables such as oil and grease—are lower than the standard or budgeted variable overheads.

What causes an unfavorable fixed overhead budget variance?

If Connie’s Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). In addition to the total standard overhead rate, Connie’s Candy will want to know the variable overhead rates at each activity level. Two variances are calculated and analyzedwhen evaluating fixed manufacturing overhead. The fixedoverhead spending variance is the difference between actualand budgeted fixed overhead costs. The fixed overheadproduction volume variance is the difference between budgetedand applied fixed overhead costs.

- Suppose Connie’s Candy budgets capacity of production at 100% and determines expected overhead at this capacity.

- Then throughout the period, every time we produce one unit, we record the allocation rate.Since there are only two elements that go into this calculation, that means that there are onlytwo things that can actually change.

- After the reasons have been highlighted the company takes measures to deal with any material variances throughout the year to minimize costs.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

How to Compute Various Overhead Cost Variances

The difference between the actual amount of fixed manufacturing overhead and the estimated amount (the amount budgeted when setting the overhead rate prior to the start of the year) is known as the fixed manufacturing overhead how to make a commercial invoice budget variance. For all three of the prior variance analysis methods, we had a price variance and an efficiency variance. Figure 10.14 summarizes the similarities and differences betweenvariable and fixed overhead variances.

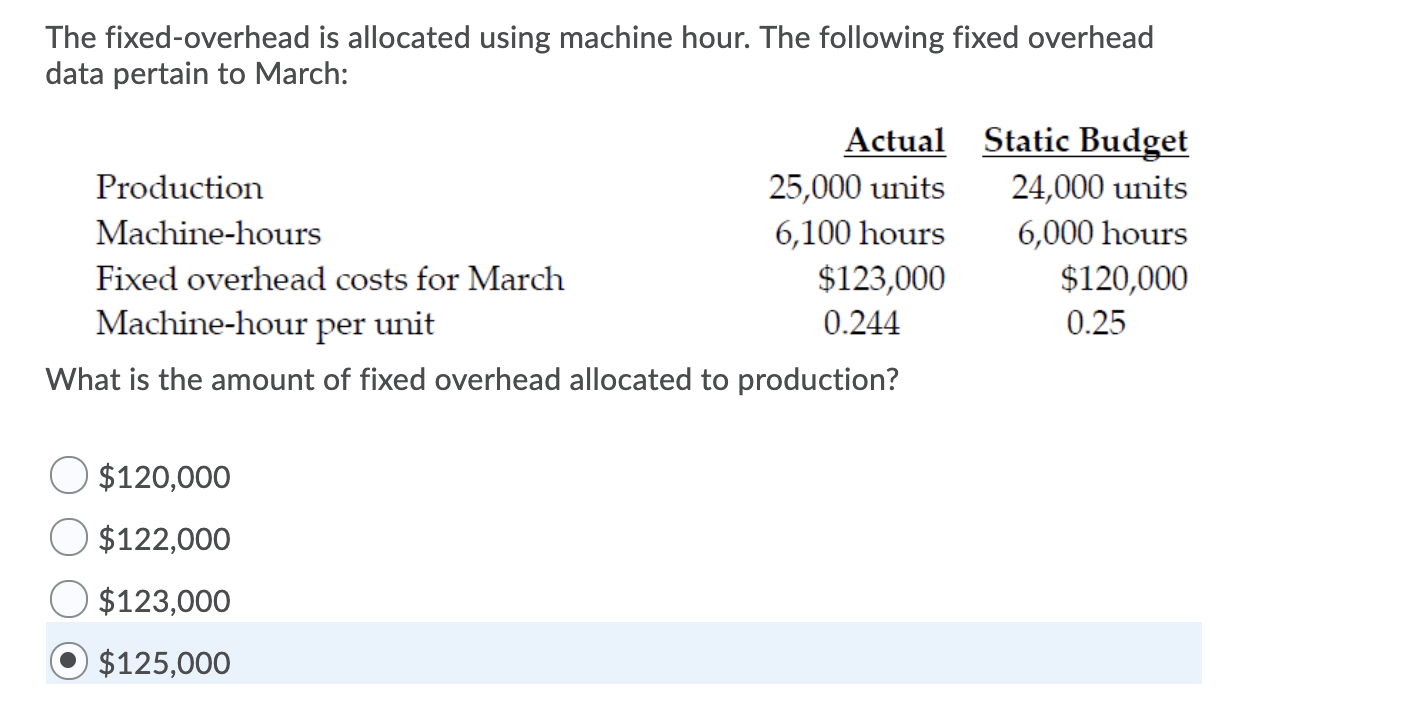

Various methods can be used to allocate the fixed overhead including for example, the number of direct labor hours used in production or the number of machine hours used. Fixed Overhead Spending Variance is calculated to illustrate the deviation in fixed production costs during a period from the budget. The variance is calculated the same way in case of both marginal and absorption costing systems. If the actual production volume is higher than the budgeted production, the fixed overhead volume variance is favorable. On the other hand, if the actual production volume is lower than the budgeted one, the variance is unfavorable.

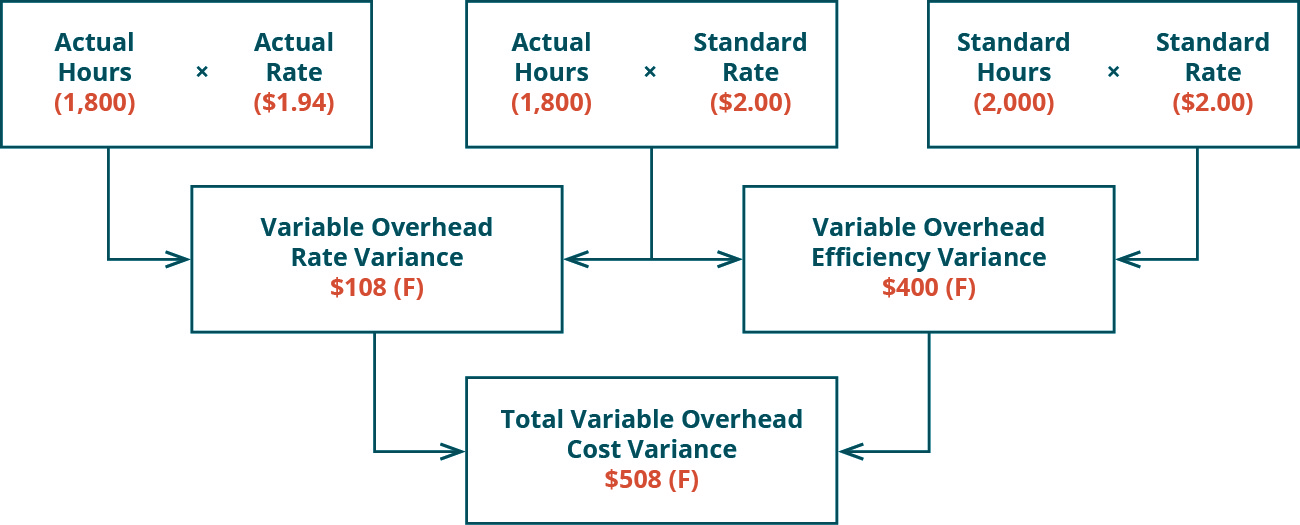

The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. The fixed overhead volume variance is also one of the main standard costing variances, and is the difference between the standard fixed overhead allocated to production and the budgeted fixed overhead. A favorable fixed overhead spending variance arises when the actual fixed overheads incurred by the company are lower than the budgeted fixed overheads. Variable overhead spending variance is the difference between actual variable overhead cost, which is based on the costs of indirect materials involved in manufacturing, and the budgeted costs called the standard variable overhead costs. As a result, the company has an unfavorable fixed overhead variance of $950 in August.

Fixed overhead costs are the indirect manufacturing costs that are not expected to change when the volume of activity changes. Some examples of fixed manufacturing overhead include the depreciation, property tax and insurance of the factory buildings and equipment, and the salaries of the manufacturing supervisors and managers. An overhead cost variance is the difference between how much overhead was applied to the production process and how much actual overhead costs were incurred during the period.

Therefore, these variances reflect the difference between the Standard Cost of overheads allowed for the actual output achieved and the actual overhead cost incurred. A portion of these fixed manufacturing overhead costs must be allocated to each apron produced. This is known as absorption costing and it explains why some accountants say that each product must “absorb” a portion of the fixed manufacturing overhead costs. Suppose Connie’s Candy budgets capacity of production at 100% and determines expected overhead at this capacity. Connie’s Candy also wants to understand what overhead cost outcomes will be at 90% capacity and 110% capacity.

Overhead variances arise when the actual overhead costs incurred differ from the expected amounts. Managers want to understand the reasons for these differences, and so should consider computing one or more of the overhead variances described below. It is not necessary to calculate these variances when a manager cannot influence their outcome. The fixed manufacturing overhead volume variance is the difference between the amount of fixed manufacturing overhead budgeted to the amount that was applied to (or absorbed by) the good output. If the amount applied is less than the amount budgeted, there is an unfavorable volume variance.

The fixed overhead volume variance is the difference between the amount of fixed overhead actually applied to produced goods based on production volume, and the amount that was budgeted to be applied to produced goods. For example, a company budgets for the allocation of $25,000 of fixed overhead costs to produced goods at the rate of $50 per unit produced, with the expectation that 500 units will be produced. However, the actual number of units produced is 600, so a total of $30,000 of fixed overhead costs are allocated. The fixed overhead spending variance is a type of variance analysis used to measure the difference between the actual fixed overhead costs incurred by a company and the budgeted or expected fixed overhead costs.

The standard variable overhead rate is typically expressed in terms of the number of machine hours or labor hours depending on whether the production process is predominantly carried out manually or by automation. A company may even use both machine and labor hours as a basis for the standard (budgeted) rate if the use both manual and automated processes in their operations. Since the fixed manufacturing overhead costs should remain the same within reasonable ranges of activity, the amount of the fixed overhead budget variance should be relatively small. Companies typically establish a standard fixed manufacturing overhead rate prior to the start of the year and then use that rate for the entire year.